Samsung C&T has made it through a challenging proxy season with its shareholders backing its 10 percent increase plan for dividend payouts, averting resistance from activist funds that called for significantly higher returns. Its shares sank nearly 10 percent after the general shareholders meeting took place Friday.

The company's proposal to pay a dividend of 2,550 won ($1.90) per common share and 2,600 won for each preferred share was approved. Among valid stocks with voting rights, 77 percent voted for the plan at the meeting held at Samsung Global Engineering Center in Seoul.

The total dividend payout for the fiscal year of 2024 has been confirmed as 417.3 billion won, up 10.9 percent from a year earlier.

Five foreign activist funds, including City of London Investment Management and Whitebox Advisors, proposed a plan for the company to pay 4,500 won for each common share and 4,550 won per preferred share, some 75 percent higher than Samsung's proposal.

Over the activist funds' proposal, Samsung expressed concerns the "substantial cash outflow" would cause business management difficulties, and urged shareholders to vote against the proposals.

As the foreign activist funds combined hold a mere 1.46 percent -- far below the possession of the Samsung Group ownership family amounting to over 30 percent -- the voting result was largely expected. But the activist proposal still garnered 23 percent, showing that many minority shareholders desired an enhanced shareholder return policy.

"Even though the figure represents less than half of the shareholders, it still shows shareholders are not that satisfied with Samsung's current shareholder return plan," a stock analyst said under the condition of anonymity.

At the shareholders meeting, the activist funds' proposal demanding the company buy back 500 billion won of its own shares also fell through, with 18 percent in favor and 72 percent either against or abstaining.

“Despite the outstanding performance of company’s blue-chip assets, shareholders continue to see losses in their investment. Its inefficient capital allocation, weak corporate governance and unclear strategy are preventing shareholders from gaining the profits from growth,” Do Hyun-su, an attorney from the Lin law firm representing the activist funds, said at the shareholders meeting.

"And the need to improve capital allocation and shareholder returns is supported by domestic and foreign proxy advisers and minority shareholders."

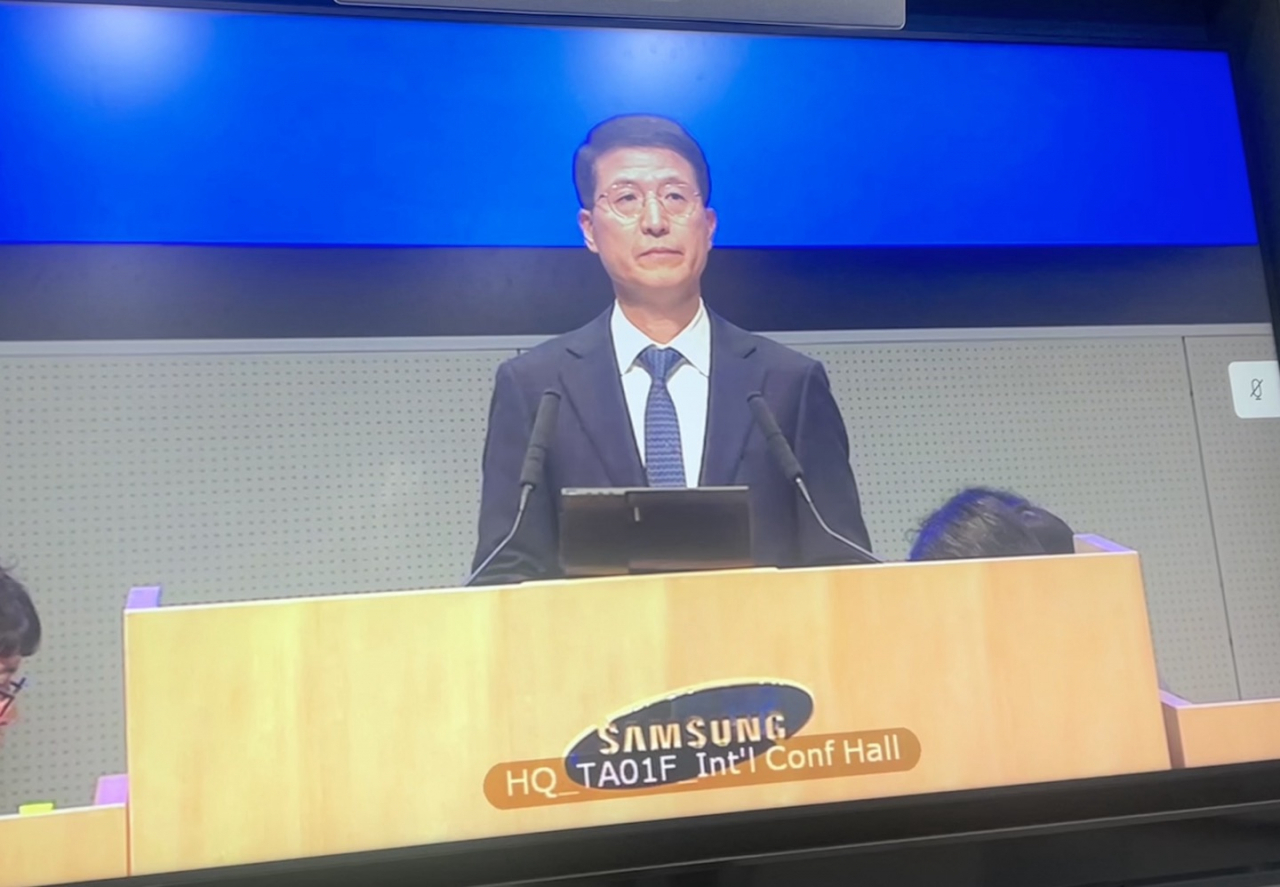

Oh Se-chul, the president leading the construction division at Samsung C&T, reiterated the company's strategy to spend 70 percent of the dividends the company earns from its affiliates on shareholder dividend payouts, and to use all of the profits made from business operations on future investment.

"We will allocate dividend income from affiliates to shareholders, and focus on expanding the green energy sector and enhancing existing shareholder value in bio-health care under the principle of reinvesting in the business," Oh said.

The company will stick to the current shareholder return policy -- the three-year plan starting this year -- but will continue to listen to shareholders' opinions and reflect them in the next round of policy after the fiscal year of 2025.

Instead of buying more of its own shares, the company has announced it will gradually cancel all treasury shares it already holds, which account for 13.2 percent of issued shares, until 2027.

At the meeting, some shareholders expressed disappointment over the low dividend payout that "fails" to reflect the company's increasing profit.

“Dividends are paid out of affiliate income. Samsung C&T pays dividends out of the dividends it gains from the affiliates. But normally, companies pay dividends from the profit they make doing business," one shareholder said.

Another shareholder expressed anger that the company's share price remains similar to that of nine years ago, and that its plan for investment is not reflected in the stock price.

"Samsung C&T maintains that it will be spending the business profit for future investment, and it is seeing increasing earnings. So then, when will we shareholders make profit from our investment?"

Samsung C&T says it is committed to enhancing shareholder returns, and announced its shareholder return program for 2023 to 2025 in February last year.

Under the plan, the company said it will redistribute 60 to 70 percent of dividend income from group affiliates to dividend payouts, and will allocate operations earnings to investment.

The activist funds, however, claim the program is "skewed" toward investment, does not properly improve shareholder returns and ultimately fails to address the company's valuation problem.

As of November last year, the company's total net assets were 54.1 trillion won, but its market cap was only 17.9 trillion won, showing a value gap of 36 trillion won.

Since the merger, Samsung C&T's net asset value discount rate has grown to reach around 70 percent last year. Shareholder return also remained stagnant in the past decade, even as listed affiliates Samsung Electronics and Samsung Biologics witnessed growth of 291 percent and 445 percent, respectively, in total returns.

Samsung C&T's share price declined by 9.78 percent to close at 154,100 won at Friday's closing bell.