A signboard at a self-service gas station in Seoul shows the recent rebound in gasoline prices on July 5. While the nationwide barometer climbed to 1,359.67 won per liter as of July 8, prices in Seoul hover over 1,400 won. (Yonhap)

SEJONG -- The V-shape rebound in gasoline prices in the local market is emerging as a factor that could restrict the recovery of the sagging economy.

Gasoline prices have bounced back rapidly in South Korea over the past two months, in keeping with the normalization of international crude prices.

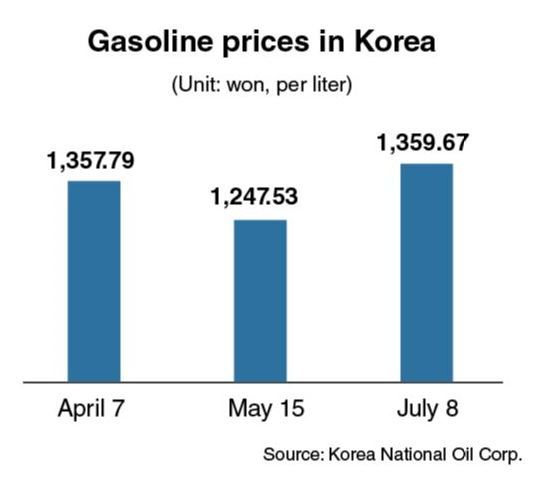

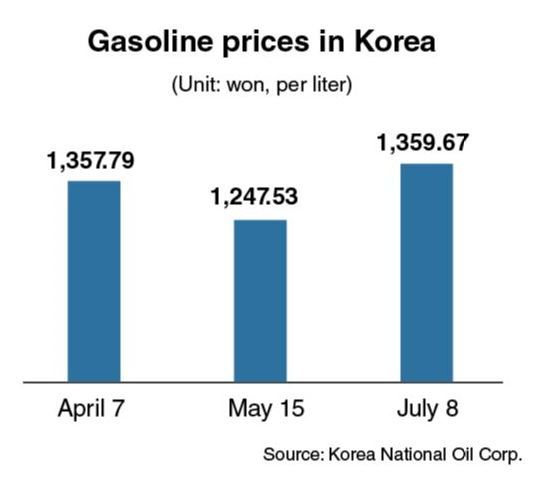

As of July 8, gasoline prices reached 1,359.67 won ($1.16) per liter, which is the highest since 1,362.90 won on April 6.

The prices -- which dipped to 1,247.53 won on May 15 amid the COVID-19 pandemic -- climbed for the 54th consecutive trading session.

The level could still be regarded as cheap, compared to that of past years. But the rising prices still increase the burden on ordinary households and some small manufacturers.

(Graphic by Kim Sun-young/The Korea Herald)

“I am still reluctant to use public transportation due to the coronavirus. As a car driver during commuting hours or other weekdays, it is uneasy to see higher price tags at gas stations,” one salaried worker in Sejong said.

The situation is the same with drivers of sport utility vehicles. Diesel prices, which fell to 1,058.76 won per liter on May 15, rose to 1,162.63 won on July 8.

International crude prices are fast recovering. Western Texas Intermediate, which generally ranged between $15 and $30 per barrel (aside a sudden sharp dip to minus $37.63 on April 20) from mid-April to mid-May, has continued to climb to trade at $40.62 as of July 7.

Dubai crude, which makes up the dominant portion of Korea’s petroleum imports, and Brent crude are priced at $43.09 and $43.08 per barrel, respectively, on July 7.

But another sharp increase in the number of coronavirus infections at home and abroad could hamper a further increase of oil prices.

A second round of proliferation of the epidemic in Korea and some other countries could also stall or reverse the increase in prices of crude and gasoline in the local market.

Weaker demand around the globe will inevitably pull down the crude prices.

In that scenario, however, the Korean won is likely to call in value as investors rush to safe havens like the US dollar and the Japanese yen.

The dollar hovered around 1,220-1,230 won between April and May. After peaking at 1,240 won on May 28, it has since retreated to trade at 1,195 won as of July 8.

The Japanese currency also weakened, to 1,110 won per 100 yen, after reaching 1,154.47 won on May 29.

As a fixed formula, the weak won benefits local exporters’ price competitiveness, but it will slash the purchasing power of ordinary households.

A strong dollar could also cause outflow of foreign capital in the local stock market.

Irrespective of the coronavirus, the local currency has generally lost ground to the greenback over the past two years since strengthening to 1,055.5 won against the dollar on April 2, 2018.

By Kim Yon-se (kys@heraldcorp.com)

![[AtoZ into Korean mind] Humor in Korea: Navigating the line between what's funny and not](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/22/20240422050642_0.jpg&u=)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Graphic News] 77% of young Koreans still financially dependent](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/22/20240422050762_0.gif&u=)